The launch of Runes on block 840,000 was heralded as a revolution for the Bitcoin network. Prior to the launch of Runes, tokens on Bitcoin were the talk of Twitter, despite the blockchain being bogged down by the inefficient meta protocol using ordinal theory to create BRC-20 tokens.

BRC-20 tokens captured the imagination of speculators due to their fair mint issuance, but they had shortcomings; being an account model built on top of the underlying UTXO model would result in a larger data footprint and the creation of dust transactions.

The Runes protocol promised a more resource-efficient way to spam the chain with tokens. Building on the momentum generated by BRC-20 tokens and the various tokens now trading in these secondary markets, Runes was ready to formalise this new token market.

Envisioned as a way to expand Bitcoin’s functionality and drive demand for block space, It would, in turn, incentivise miners with new fee revenue, making it more profitable to process transactions.

However, missteps have left the protocol struggling to gain traction, so what exactly went wrong?

Runes, the fall guy

The launch of Runes had plenty of backing from the Ordinal enjoyers, so much so that they held off minting new BRC-20 tokens because once Runes went live, you needed the Bitcoin to etch those brand new tickers or grab your allocation of the first Runes.

When the halving occurred, many speculators wanted to mint a Rune within the first block of Bitcoin’s halving, paying astronomical fees alongside other users bidding for inclusion in that historically significant block.

The rush to secure the first few blocks saw Bitcoin speculators pay $2.4 million to miners to store less than 4MB of transaction data within Bitcoin’s 840,000th block.

It was a promising start.

Yet a couple of days later, many Runes prices have already started cratering, in what looks like a sell-the-news moment. The interest in etching and claiming Runes has declined steeply, with prices dumping and liquidity drying up.

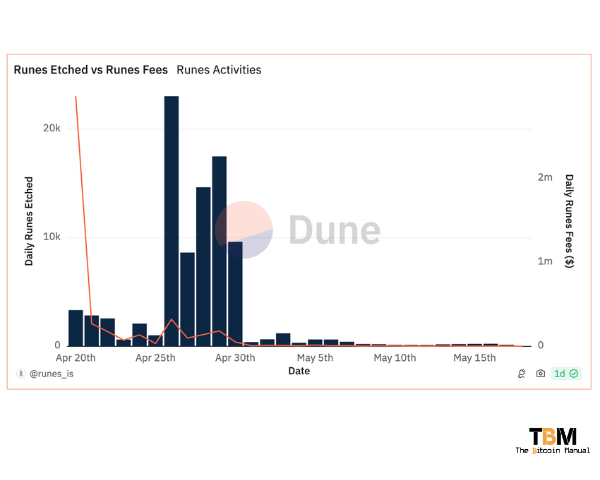

Since the week of Runes’ launch on the Bitcoin network, there has been a dramatic 99% decrease in daily etchings.

Only 157 Runes were recorded on May 13, down from a peak of 14,700 in late April.

On April 26, a record 23,061 Runes were etched, but the recent drop has seen transaction fees from etchings fall from the peak of $2.9 million to a paltry US$3,835 per day.

Over 91,200 Runes have been etched on the Bitcoin blockchain, with most of them dead on arrival.

There is a lot of sizzle and no proof of steak

Runes have failed to capture the imagination of the crypto community, particularly its target audience, the “meme coin” crowd known for their high-risk, high-reward investments.

In its pursuit of avoiding ticker squatting, Runes kicked off with a ticker symbol release system, where users could ‘etch’ desired symbols onto Runes, starting with unusually long ticker symbols by design. Not including spaces, all runes must have at least 13 characters.

Shorter ticker symbol lengths will slowly unlock for the next four years. This design choice poured cold water on the need to secure Runes now because apes can’t degen into securing prime ticker symbols like ‘PEPE’ or ‘DOGE’.

Truth be told, meme coin minters aren’t very creative. Even given the freedom of 13 characters, they couldn’t think of anything funny enough to mint.

Sad but true!

Memecoiners aren’t the funniest; all they do is repurpose old memes that Bitcoiners created years ago.

Pre-mines are a touchy subject

Further adding to the scepticism was the revelation of a pre-mine allocation for Runes. Yes, a Rune can be issued with a pre-mine allocation specified in the etching transaction, which means a portion of Runes can be created before the launch.

This raises concerns about fair distribution and potential manipulation, clashing with the project’s initial claims of being a community-driven initiative.

Degen gambling, the new block subsidy

Ordinals and Runes were promoted as a way to increase block space usage and generate a reliable source of transaction fees for miners. This additional revenue stream was supposed to offset the decrease in miner revenue caused by the halving Bitcoin block subsidy. However, the assumption that Ordinals and Runes would create a consistent stream of fees has yet to be borne out.

The fees generated by these secondary assets are highly volatile and tend to fluctuate based on social media trends. As of today, Bitcoin transaction fees are around ten sats per vbyte, which is significantly lower than the levels anticipated by proponents of Ordinals and Runes.

Ordinals and Runes have not lived up to their initial promise of providing a reliable source of miner revenue.

I thought you wizards and OP_CATs broke Bitcoin, but here I am, securing on-chain Bitcoin on the cheap and rebalancing Lightning channels in the third world, and it is working just fine.

Go figure!

Who would have thought unregulated security token market shills would make up some nonsense narrative to justify their need to gamble and sucker in retail exit liquidity?

Not me!

If the first 10 don’t work, wait for 4 letter tickers cope

The first 10 Runes, often dubbed the Genesis Runes, hold a special significance for the Runes protocol’s potential success. They are the core tokens that would keep the market going as the wait for the premium ticker rollout continues.

Historical significance

These Runes represent the protocol’s very first creations. They act as historical artefacts, similar to the first Bitcoin block mined. If the protocol takes off, the token value might increase simply due to its unique historical position, so its performance becomes the barometer of its success.

If the founding tokens aren’t increasing in price, market cap, daily volume, and number of unique holders, what hope does any meme coin coming after them have to buck the trend?

Demonstrating functionality

Widespread interest in etching and trading the first Runes would showcase the protocol’s functionality, prove users can interact with Them, and create a market for them.

If there is demand for the first few tokens, you would likely see wallets and exchanges jump on board to support it and expand the network effect.

The first few tokens are meant to build the rails for the protocol, but if they’re already failing, why would any business or developer bother to add support for it?

Setting a precedent

Popular first Runes could set the stage for future Rune creations. If they are successful and enrich a few people, it would inspire other speculators to gravitate towards the protocol to try and make their fortune at this new on-chain casino.

While the Genesis Runes serve as a testing ground for the Runes protocol, their lack of initial popularity and the lengthy wait (four years) for desirable ticker symbols lose their star power as a beacon of hope.

Four years in the fast-paced world of cryptocurrency is a significant amount of time, and there’s no guarantee that Runes will remain culturally relevant to the notoriously fickle crypto investor community when these premium tickers become available.

So long, suckers, thanks for all the tips

In the game of speculation, there’s no guarantee that the turd you’re throwing at the wall will stick sometimes; you can briefly capture lightning in a bottle, which garners social media attention and crypto press coverage, which brings in a sizable amount of dumb money, while other times, you’re just a few degen traders trying to rug one another, in a smaller game of musical chairs.

You either get out early and secure legendary status as you dump metadata on naive traders and bag that 1000x, or you live long enough to see yourself become someone else’s exit liquidity.

Nobody knows what will stick around and capture the masses’ hearts, minds and wallets, and it looks like Runes has run its course for now. Only a small amount of speculative new money entered the secondary markets for these collectable satoshis, so very few had the ability to exit and now sit with heavy Rune, BRC-20 and Ordinal NFT bags.

As a result, Ordinals, Inscriptions, Rare Sats, and Runes traders can no longer afford to overpay miners for on-chain transaction fees continually, and their enthusiasm to keep trying to strike it rich on a moon bag mint also starts to fade.

Deixar uma resposta